Principal Controlling Officer and Know Your Customer

Published: August 26, 2021 / Last Updated: January 30, 2024

by Janet Bargewell, GiveDirect Support

by Janet Bargewell, GiveDirect Support

Principal Controlling Officer (PCO)

The principal of a corporation or charity is a person who has been authorized by the governing body of that organization to act on its behalf during any legal or tax matters that may arise. In practice this means a person who can sign documents that affect the charity, and the signature is binding.

A PCO may be an officer of the charity, such as president, vice president, founder, executive director, or a member of the board that has authority to act on behalf of the charity.

A charity may have more than one controlling officer, but for purposes of your GiveDirect account, only one PCO submission is required.

Why Do We Need To Collect Principal Controlling Officer Information?

Since we process payments on your behalf, our regulators and financial partners require us to perform identity verification. The collection of this information is intended to promote transparency and prevent individuals from using complex company structures to hide terrorist financing, money laundering, tax evasion, and other financial crimes. Identity verification requirements are now standard within the financial industry, including all payment processors.

GiveDirect will submit the PCO information to our financial partners for validation purposes only. GiveDirect does not store your sensitive information.

We are required to collect PCO information as part of a larger set of financial regulations called Know Your Customer.

What is Know Your Customer (KYC)?

Know Your Customer (KYC) is what businesses do to verify the identity of their clients.

KYC procedures ensure our customers are real and that they are not involved in illegal activities. KYC policies are governed by the U.S. Financial Crimes Enforcement Network (FinCen). These policies have evolved into an important tool to combat illegal transactions through financial institutions. KYC allows companies to protect themselves by ensuring that they are doing business legally and with legitimate entities, and it also protects the individuals who might otherwise be harmed by financial crime.

KYC procedures start by simply collecting basic data and information about our customers -- information such as names, social security numbers, birthdays, addresses, etc.

Once this basic data is collected, the information is compared to lists of individuals that are known for corruption, on a list of sanctions, suspected of being involved with a crime, or at a high risk of partaking in bribery or money laundering.

Proving One's Identity

Generally, you may simply provide the required PCO information that we ask for in your Account Profile. However, if AML or KYC checks return a "flag", additional documentation may be required before we can clear your account for payment processing.

If your PCO is asked to submit documentation of identity, acceptable forms of personal identification are:

- Passport

- Driver license or State issued ID card

- Resident permit ID / U.S. Green Card / U.S. visa card

- Birth Certificate

- 501(c)(3) letter

How To Submit PCO

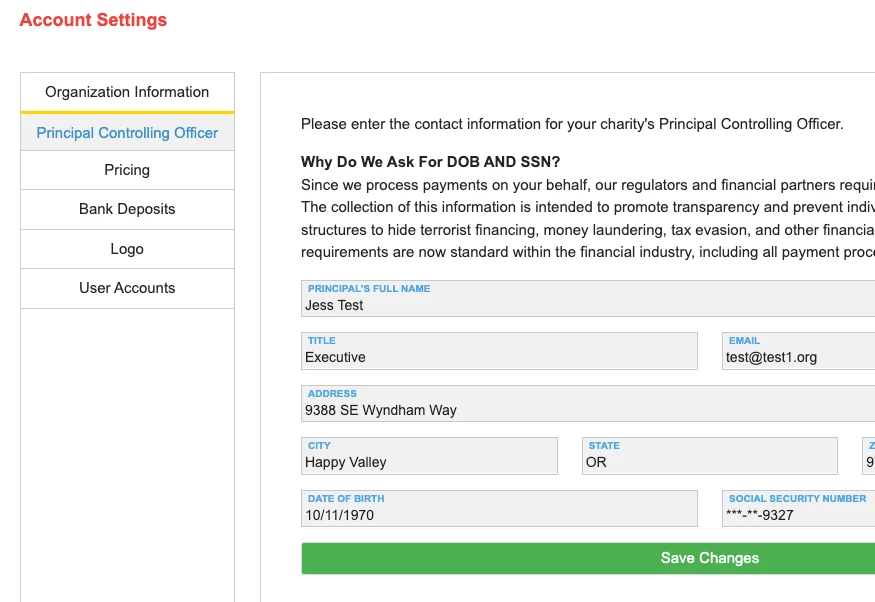

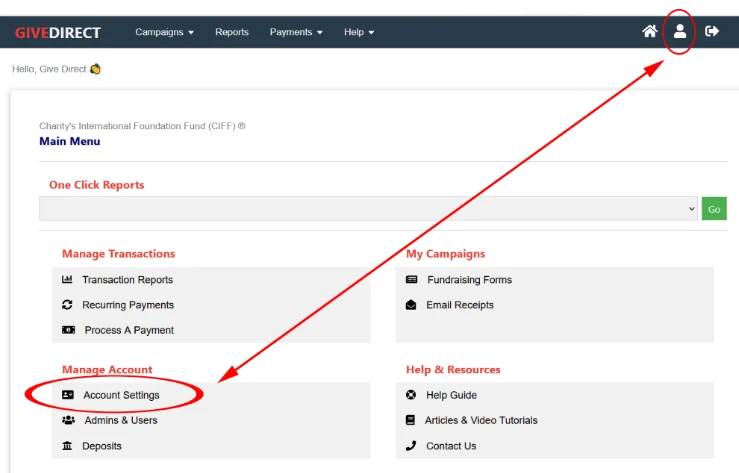

To submit PCO information, go to Account Settings in the Control Panel.

Click the Principal Controlling Officer section and complete the form.